FOR IMMEDIATE RELEASE

July 15, 2025

Manhattan, NYC — The Federal Money Services Business Association (FedMSB) today unveiled its groundbreaking 2025 Redefinition of Money proposal, a bold initiative aimed at modernizing the definition of money to reflect the realities of a rapidly evolving financial and technological ecosystem.

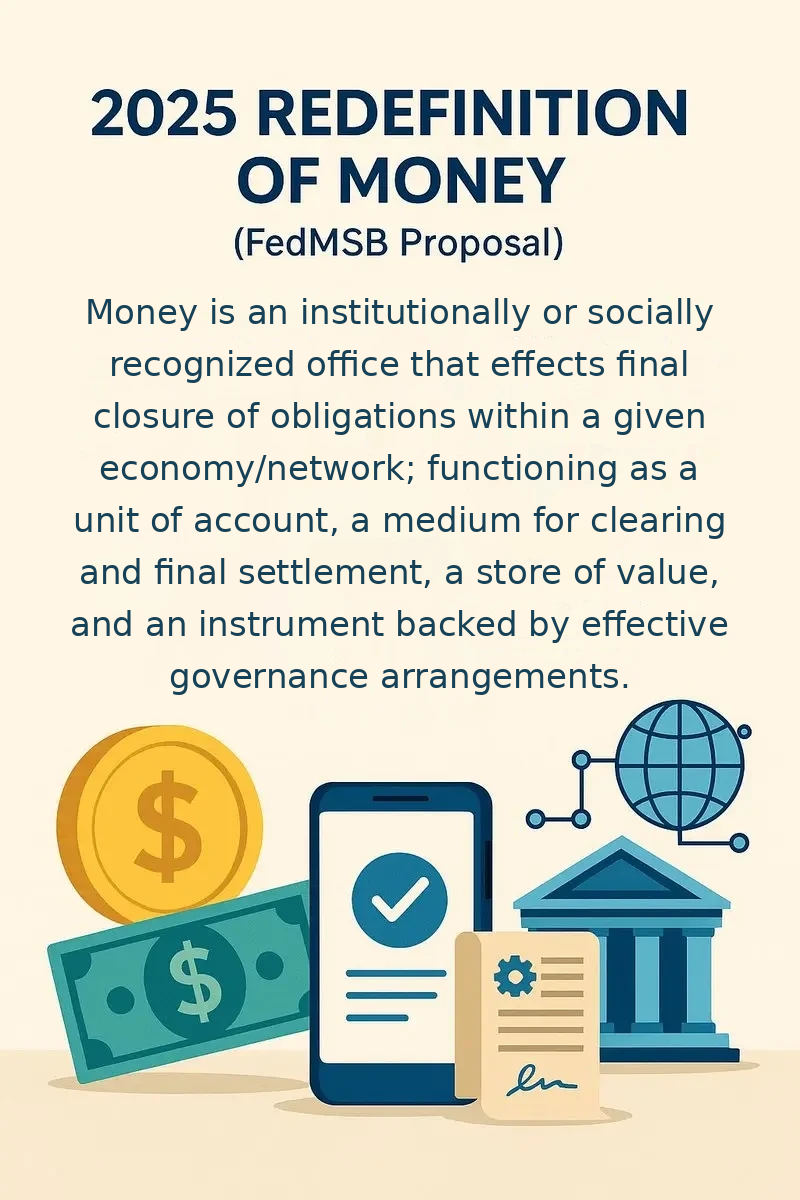

The proposed definition reads:

“Money is an institutionally or socially recognized office that effects final closure of obligations within a given economy/network; functioning as a unit of account, a medium for clearing and final settlement, a store of value, and an instrument backed by effective governance arrangements.”

This new definition expands the scope of what may be considered money, acknowledging not only traditional physical forms such as coins and notes, but also electronic representations, programmable contracts, and other transaction media authorized by law or recognized through consensus-based mechanisms. The shift underscores the growing influence of digital currencies, blockchain infrastructure, and decentralized finance (DeFi).

“This redefinition reflects a fundamental shift in how society understands and interacts with value,” said a FedMSB spokesperson. “Money is no longer confined to paper or coin.”

The proposal is designed to serve as a foundational reference for future regulatory frameworks, financial innovations, and public-private collaborations in the digital economy. It also lays the groundwork for in-depth discourse on emerging instruments such as central bank digital currencies (CBDCs), stablecoins, and tokenized assets.

As global financial systems continue to adapt to digitization and decentralization, FedMSB’s forward-looking definition aims to ensure clarity, consistency, and inclusivity in how money is recognized and regulated.

About FedMSB

The Federal Money Services Business Association is a national nonprofit trade association organized under IRC § 501(c)(6) and incorporated in the State of New York. We are not a money services business (MSB), nor do we engage in MSB-regulated activities. Rather, we serve as a neutral convener and coordinating body for a diverse community of licensed and registered MSBs, as well as their infrastructure, compliance, and fintech partners.

Founded to support the modernization of the MSB sector, FedMSB leads the development of MSB 2.0 — a forward-looking framework for digital-first, standards-aligned, and compliance-embedded operations. Through policy advocacy, industry certification, technical guidance, and educational resources, we aim to elevate the integrity, transparency, and innovation capacity of non-bank financial services.

Our Membership

FedMSB’s members include state-licensed money transmitters, digital payment providers, fintechs, and other regulated non-bank financial institutions. We also welcome associate members such as legal advisors, compliance experts, and technology vendors. Our membership reflects a broad cross-section of the MSB ecosystem — from national leaders to emerging platforms.